Not known Factual Statements About Financial Advisor Salary

Wiki Article

See This Report about Financial Advisor Salary

Table of ContentsFinancial Advisor Ratings Things To Know Before You Buy3 Simple Techniques For Financial Advisor JobsThings about Advisors Financial Asheboro NcThe Single Strategy To Use For Financial Advisor

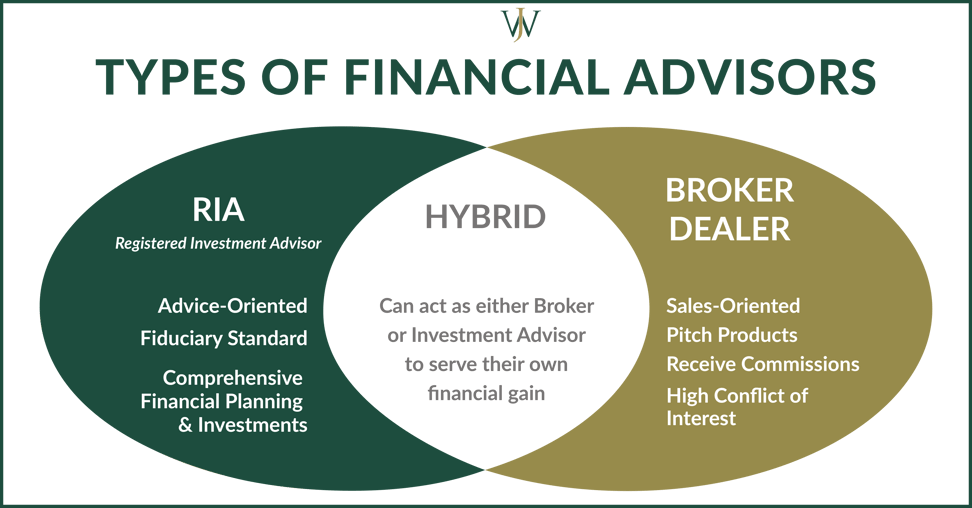

There are numerous sorts of financial advisors around, each with differing qualifications, specializeds, as well as degrees of liability. And also when you get on the quest for a specialist matched to your requirements, it's not uncommon to ask, "How do I know which economic expert is best for me?" The answer begins with an honest accountancy of your requirements as well as a bit of research study.Kinds of Financial Advisors to Take Into Consideration Depending on your financial demands, you may decide for a generalised or specialized economic consultant. As you begin to dive into the world of looking for out a monetary expert that fits your requirements, you will likely be presented with lots of titles leaving you wondering if you are calling the best person.

It is crucial to note that some monetary advisors additionally have broker licenses (significance they can market protections), but they are not exclusively brokers. On the very same note, brokers are not all qualified equally as well as are not economic advisors. This is just among the many reasons it is best to begin with a certified monetary organizer who can encourage you on your investments as well as retired life.

About Financial Advisor Ratings

Unlike financial investment consultants, brokers are not paid straight by clients, instead, they earn commissions for trading supplies and also bonds, and also for marketing shared funds and various other products.

A certified estate coordinator (AEP) is an advisor that specializes in estate preparation. When you're looking for an economic consultant, it's good to have an idea what you desire aid with.

A lot like "financial consultant," "monetary coordinator" is additionally a wide term. Someone with that said title might also have various other certifications or specializeds. No matter your specific requirements and also monetary circumstance, one criteria you must strongly take into consideration is whether a potential consultant is a fiduciary. It may surprise you to find out i loved this that not all monetary advisors are needed to act in their clients' benefits.

Getting My Financial Advisor Definition To Work

To protect on your own from someone who is simply attempting to obtain more cash from you, it's a good concept to try to find a consultant who is registered as a fiduciary. An economic expert that is registered as a fiduciary is needed, by regulation, to act in the finest rate of interests of a customer.Fiduciaries can just recommend you to utilize such products if they believe it's actually the very best financial decision for you to do so. The U.S. Stocks as well as Exchange Compensation (SEC) controls fiduciaries. Fiduciaries who fail to act in a customer's benefits could be hit with fines and/or jail time of as much special info as ten years.

That isn't because anybody can obtain them. Obtaining either certification requires someone to experience a selection of courses as well as tests, along with gaining a collection quantity of hands-on experience. The result of the qualification procedure is that CFPs and also Ch, FCs are well-versed in topics throughout the area of personal money.

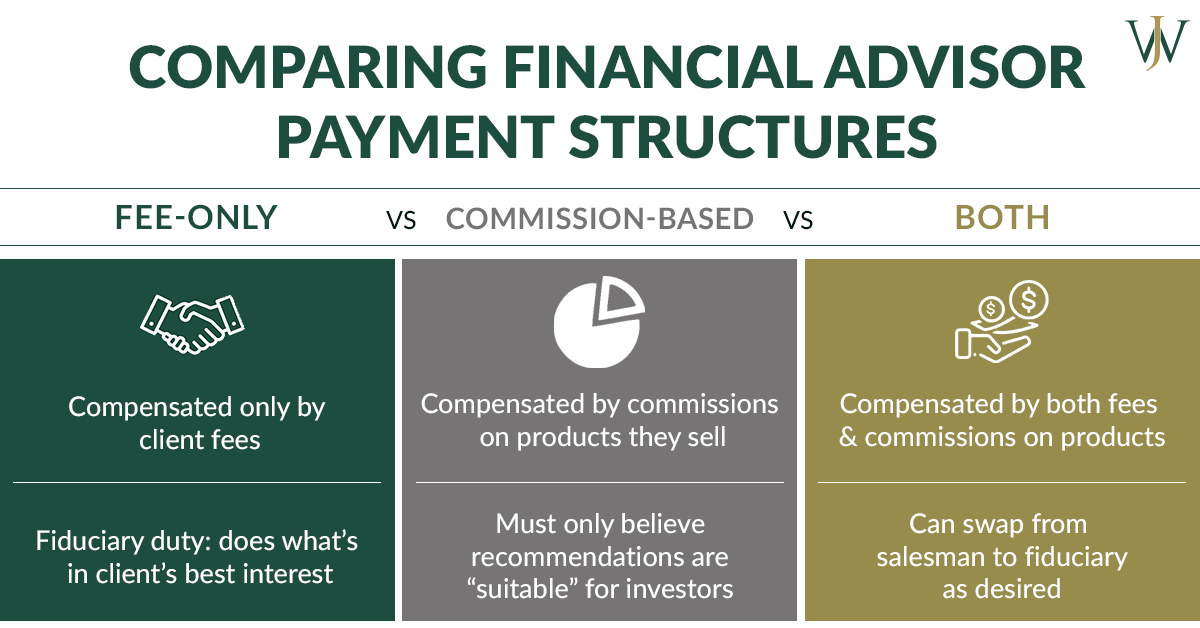

The fee can be 1. Fees usually decrease as check over here AUM rises. The choice is a fee-based consultant.

The smart Trick of Advisors Financial Asheboro Nc That Nobody is Discussing

An advisor's monitoring charge might or might not cover the prices connected with trading protections. Some consultants also bill an established charge per purchase. Make sure you recognize any type of and also all of the fees an expert charges. You do not intend to put all of your cash under their control only to deal with concealed surprises in the future.

This is a service where the expert will certainly pack all account monitoring expenses, consisting of trading charges and also expense ratios, right into one extensive fee. Since this charge covers extra, it is generally more than a charge that just consists of administration as well as omits points like trading expenses. Wrap charges are appealing for their simpleness yet likewise aren't worth the expense for everyone.

While a standard expert usually charges a fee in between 1% and also 2% of AUM, the fee for a robo-advisor is generally 0. The huge compromise with a robo-advisor is that you typically don't have the ability to talk with a human consultant.

Report this wiki page